USCC vs TIN in China: Complete Guide to Identifying Chinese Companies

1/17/2026

Key Takeaway: The Single Source of Truth

If you are doing business with a Chinese company, the Unified Social Credit Code (USCC) is the only reliable, nationwide unique identifier you should use.

In China, the Taxpayer Identification Number (TIN) for companies is not a separate code—it is the same as the USCC.

Quick Summary

- USCC: 18-character alphanumeric code.

- TIN: Identical to the USCC for all legal entities.

- Purpose: Centralized identity for tax, legal, and operational records.

Table of Contents

- What Is the USCC (Unified Social Credit Code)?

- Decoding the 18-Digit USCC

- The Relationship Between USCC and TIN

- Why the Unified System Exists

- Common Mistakes in Supplier Verification

- How to Verify a USCC Online

- FAQ: Common Questions About Chinese Company IDs

1. What Is the USCC (Unified Social Credit Code)?

The Unified Social Credit Code (USCC), or Tǒngyī Shèhuì Xìnyòng Dàimǎ (统一社会信用代码), is China's official national identifier for all legal entities.

Introduced in 2015, it replaced the "Three Certificates in One" system (Business License, Organization Code, and Tax Certificate) to create a single, efficient registration number.

Why the USCC matters

- Nationwide Uniqueness: No two entities share the same code.

- Permanent ID: The code remains with the company regardless of location changes within China.

- Comprehensive Coverage: It applies to private companies, state-owned enterprises, NGOs, and government agencies.

How to Read a USCC (The 18-Digit Structure)

Understanding the structure can help you spot obvious fakes:

- 1st digit: Registering authority (e.g., "9" for Industry and Commerce).

- 2nd digit: Entity type (e.g., "1" for enterprises).

- 3rd–8th digits: Administrative division code (Location).

- 9th–17th digits: Organization code (The unique core ID).

- 18th digit: Check digit.

Example:

91310120MA1K3X5Y2B

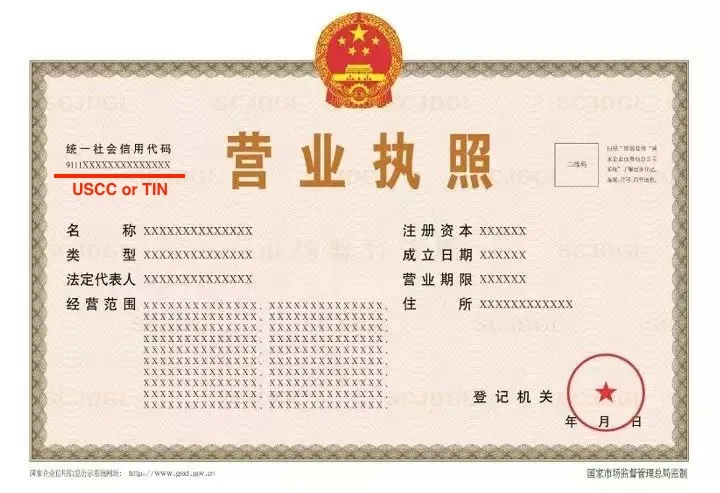

The upper left corner of the Chinese business license is USCC.

The upper left corner of the Chinese business license is USCC.

2. What Is a TIN in China?

In international finance and compliance (OECD, FATCA, CRS), TIN stands for Taxpayer Identification Number.

The Key Point for Foreign Buyers

👉 In China, the TIN for companies is the USCC.

China does not issue a separate corporate tax number. When a Chinese supplier provides their "Tax ID," it will almost always be the 18-digit USCC found on their Business License.

Comparison Table: Identifiers by Region

| Country / Region | Primary Company ID | Tax Identifier (TIN) |

|---|---|---|

| China | USCC | USCC (Same) |

| USA | EIN / State File No. | EIN |

| EU | Company Registration No. | VAT Number / Tax ID |

| UK | Company House No. | UTR / VAT No. |

3. Why China Merged Company ID and Tax ID

Before the 2015 reform, verifying a Chinese company was a nightmare. A single company might have three different certificates with three different numbers. This led to:

- Data Mismatches: Records in the tax bureau didn't match the Industry and Commerce bureau.

- Fraud Opportunities: Dishonest suppliers could hide legal troubles behind multiple IDs.

- Administrative Red Tape: High costs for both the government and businesses.

The "One Code, One License" reform solved this. Today, the same USCC is used for:

- [x] Tax filing and invoicing (Fapiao)

- [x] Customs registration (for exporters)

- [x] Court and legal enforcement records

- [x] Social security and banking (KYC)

4. Common Mistakes Foreign Buyers Make

Mistake 1: Requesting a "Separate" Tax ID

Asking for a separate TIN often leads to confusion. If a supplier gives you a number shorter than 18 characters, it is likely an obsolete "Tax Registration Number" from before 2015, which is no longer legally valid for most transactions.

Mistake 2: Relying Solely on English Names

Chinese law recognizes only Chinese names as official. English names are often unofficial translations and do not appear in government databases. 👉 Always verify using the USCC, not the English name.

Mistake 3: Accepting PDF Screenshots

With modern editing tools, altering a Business License PDF is trivial. 👉 Cross-reference the USCC with a live database.

5. How to Verify a Chinese Company Using the USCC

At ChinVerify, we specialize in bridge the data gap between Chinese official records and international buyers.

Step-by-Step Verification Checklist:

- Request the Business License: Ask for a high-quality scan.

- Locate the USCC: Find the 18-digit code (usually at the top right).

- Run a Search: Use our China Company Search Tool to check real-time status.

- Interpret the Signals:

- Green: Active and no major legal issues.

- Yellow: Recent address changes or minor administrative penalties.

- Red: On the "Dishonest Debtor" list or "Abnormal Operations" list.

All results on ChinVerify are translated into English and simplified into risk-based reports, so you don't need to read Mandarin to know if your supplier is safe.

FAQ: Common Questions About Chinese Company IDs

Is every Chinese company required to have a USCC?

Yes. Since 2017, the transition period ended. Any company without a USCC is not legally allowed to operate or issue invoices.

Can I find a company's USCC by searching its English name?

Usually, no. Government databases are in Chinese. However, premium tools like ChinVerify use AI mapping to help match known English trade names to their official USCC.

What should I do if the USCC on the contract doesn't match the Business License?

Stop immediately. This is a major red flag for fraud or a "bait and switch" where you are signing with a shell company instead of the actual manufacturer.

Is the USCC the same as the "Business Registration Number"?

In the current system, yes. The USCC has replaced the old 15-digit registration numbers.

Final Thoughts

The USCC is the "DNA" of a Chinese company. Understanding that it also serves as the TIN simplifies your due diligence process. By focusing on this single 18-digit code, you can unlock a wealth of information about your supplier's legal standing, tax compliance, and reliability.

Ready to verify a company?

Start your search now with our free company verification tool. Get instant access to official registration data.

Go to Checker